Interested in becoming a thINCubated company? As a NYS Innovation HotSpot we’re able to provide free resources such as facility access, mentor services and tax benefits for qualifying companies.

To qualify as a ThINCubated company, you must complete a multi-week Refinery program designed to build and demonstrate business viability, or show that the business has the potential to move towards attracting investment capital or profitability.

To qualify as a ThINCubated company, you must complete a multi-week Refinery program designed to build and demonstrate business viability, or show that the business has the potential to move towards attracting investment capital or profitability.

All incubated companies agree to meet periodically with business mentors on business development goals and strategic planning initiatives, and agree to share required business metrics that support our Innovation HotSpot grant reporting.

ThINC Benefits Include:

- Free utilization of ThINCubator Facility

- Mentor Services

- Copy/Print Services

- Mailbox / Receiving Services

Potential Tax Benefits Include:

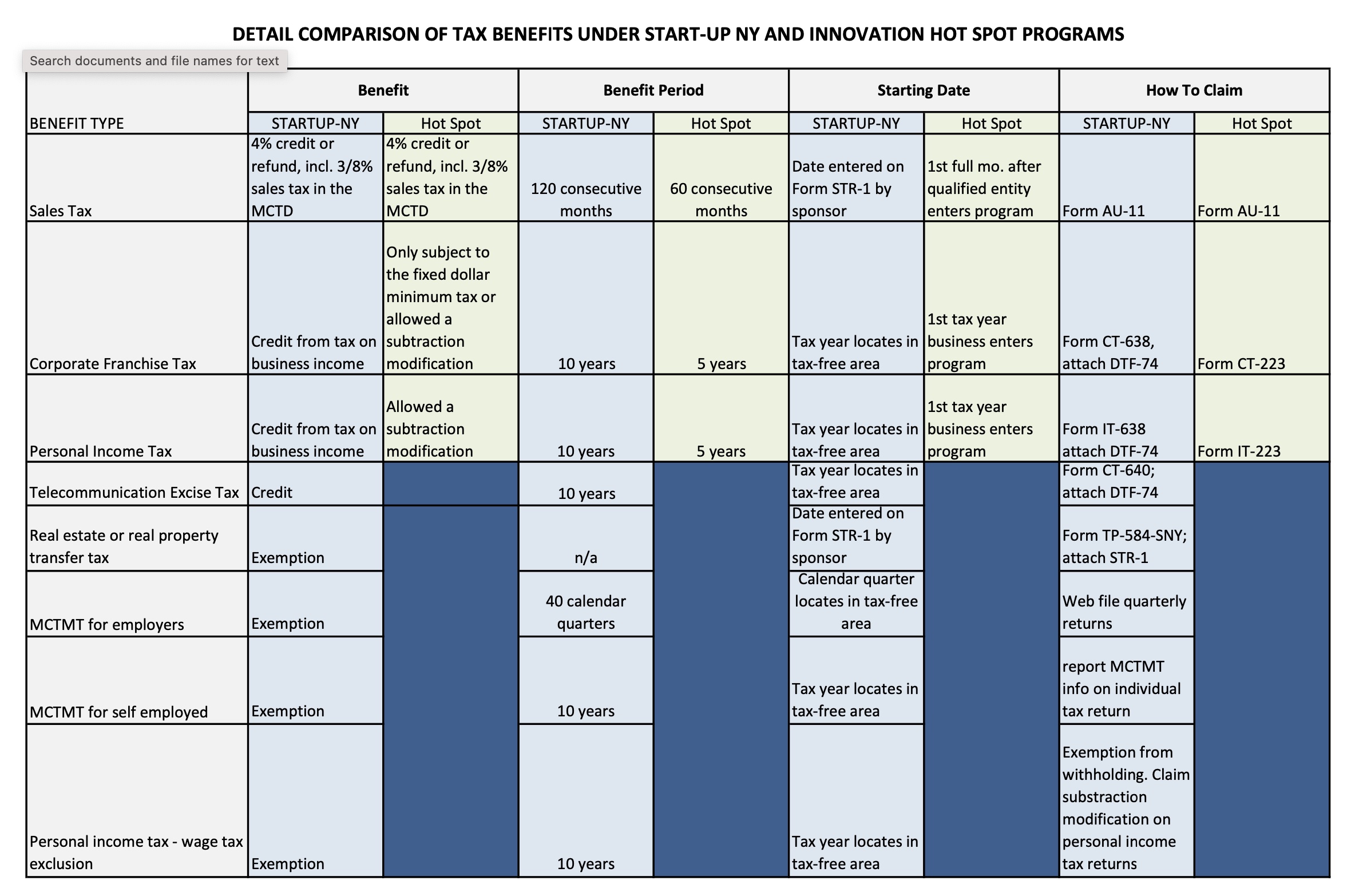

- Sales Tax Credits: 4% credit or refund, incl. 3/8% sales tax in the MCTD

- Personal Income Tax: Allowed a subtraction modification

- Corporate Franchise Tax: Only subject to the fixed dollar minimum tax or allowed a subtraction modification

The NYS INNOVATION HOT SPOT PROGRAM is available to new businesses in the formative stages of development. An innovation hot spot is a designation granted to a New York State incubator and must be affiliated with and have the support of at least one college, university, or independent research institution.

A qualified entity means a business enterprise that is in the formative stages of development and is located in NYS. It must be certified by a NYS innovation hot spot as being approved to locate in, or be a part of a virtual incubation program operated by that innovation hot spot.

A corporation franchise tax benefit and, under certain circumstances, a personal income tax benefit is allowed for five tax years. Depending on the business’s tax filing status, a corporation franchise or a personal income tax benefit is allowed.

A qualified entity is eligible for a credit or refund of the 4% state sales and use tax and the 3/8% tax imposed by the state in the Metropolitan Commuter Transportation District on the purchase of tangible personal property, certain utility services, and other taxable services. The credit or refund will be allowed for 60 months beginning with the first full month after the qualified entity becomes.